“The downstream demand in the rare earth market this month was lower than expected, and the overall situation is in a weak adjustment state. Except for the continuous rebound in prices of dysprosium and terbium products, the overall prices of other products have shown a fluctuating downward trend due to fewer new orders and low purchasing willingness of enterprises. At present, the rare earth market is about to enter the off-season, and the overall rise in rare earth prices is weak. If there is no good news to stimulate in the short term, it is difficult for rare earth prices to quickly decline. It is expected that the rare earth market will remain weak in the future.”

Overview of Rare Earth Spot Market This Month

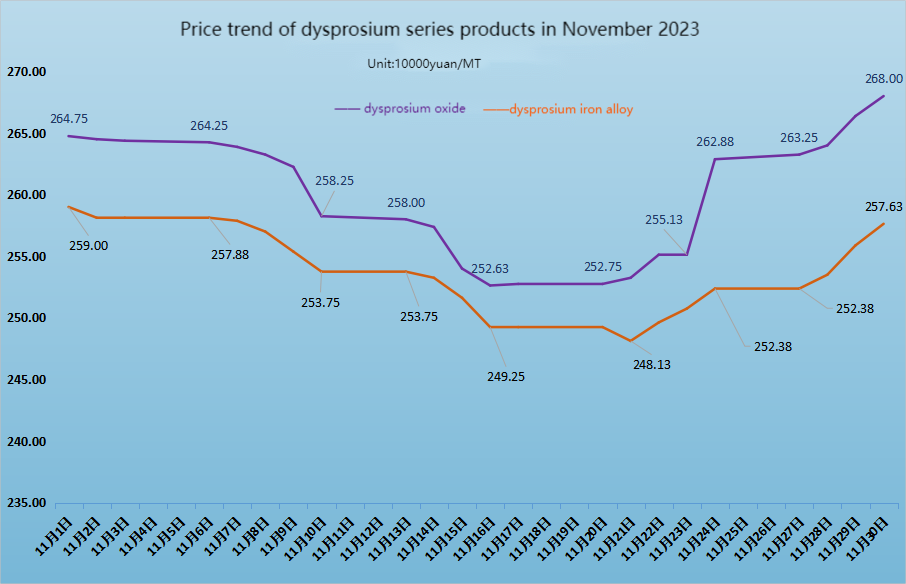

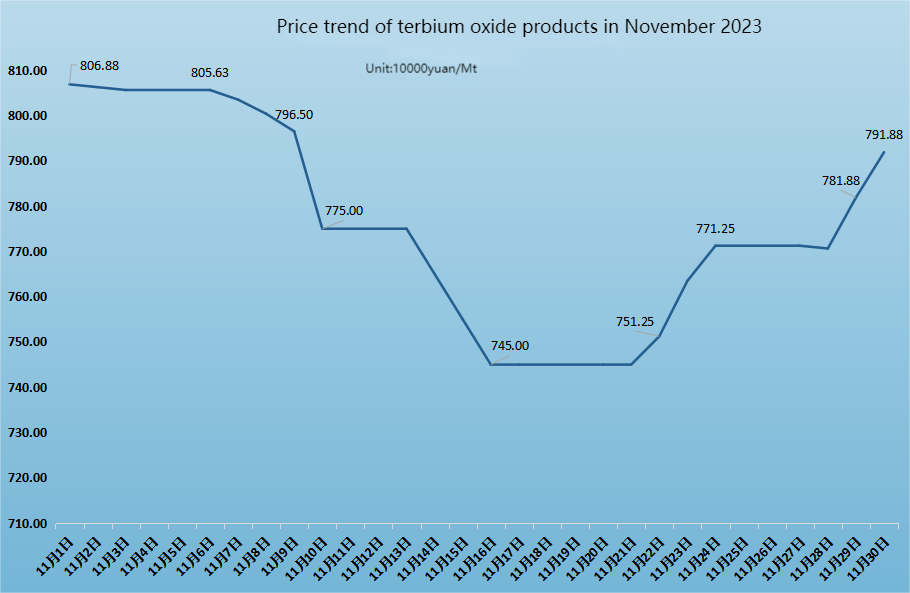

The overall price of rare earth products has fluctuated and fallen this month, with a significant decrease in trading volume. The price of praseodymium neodymium products is difficult to stop, and has been declining all the way. Dysprosium and terbium products continued to fluctuate and fall in the first half of the year. Later, due to the influence of group procurement and the reluctance of holders to sell and raise prices, prices rose tentatively in the second half of the year, with a slight increase in trading volume.

At present, upstream separation enterprises have higher production costs, some enterprises have stopped production and reduced production, spot production has decreased, and shipments have tightened. However, the import volume of rare earth raw materials is relatively high. In the first ten months of 2023, China's rare earth import volume increased by 40% year-on-year, indicating sufficient market supply. Downstream on-demand procurement puts pressure on metal spot transactions and makes it difficult for prices to rise. Neodymium iron boron production enterprises generally start production at around 70-80%, with no significant increase in new orders. At the same time, prices continue to decline, and magnetic material enterprises have a lower willingness to purchase. Production is mainly based on inventory consumption. The procurement of waste recycling is not active, and the willingness to ship is not high due to the impact of price decline, resulting in overall sluggish transactions. The market activity has decreased, and traders have increased their monetization of profits, leading to increased panic. At the same time, the announcement of listed prices for rare earths in the north is approaching, and most merchants remain cautious and watchful.

The price trend of mainstream products

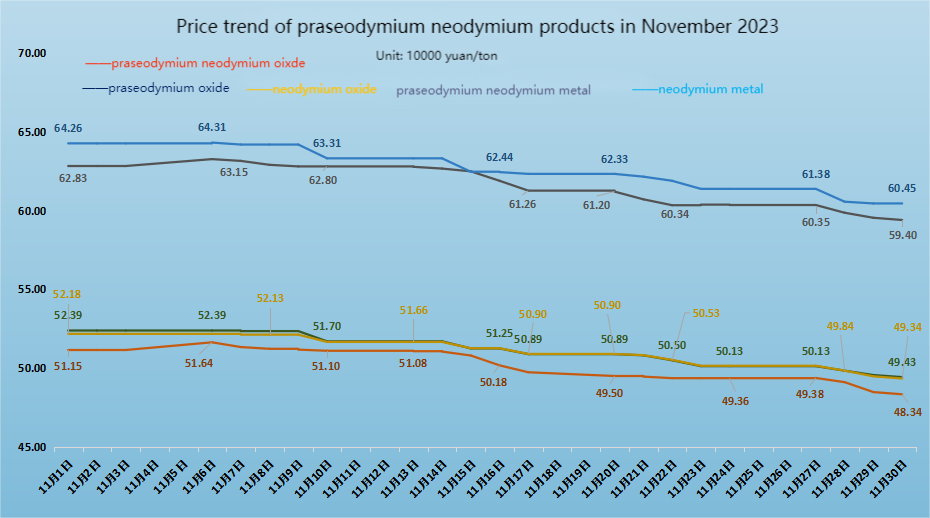

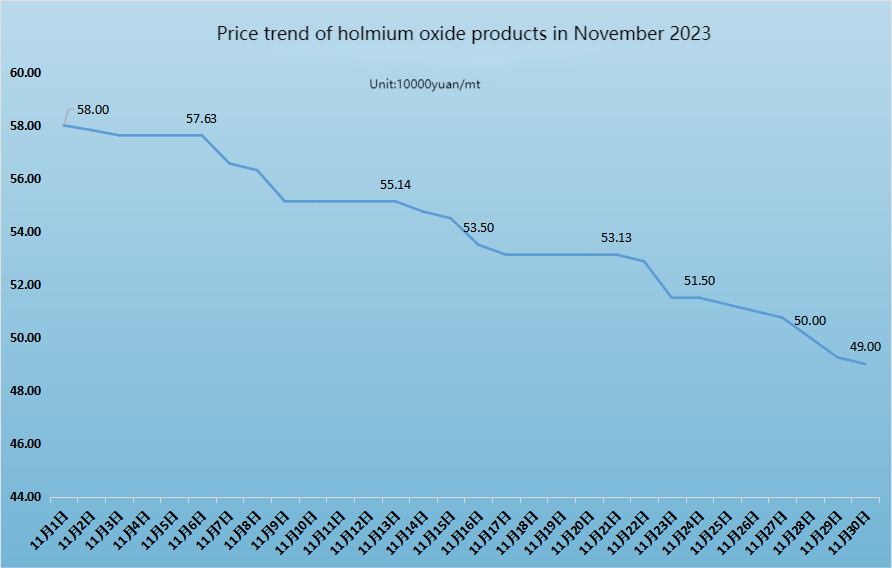

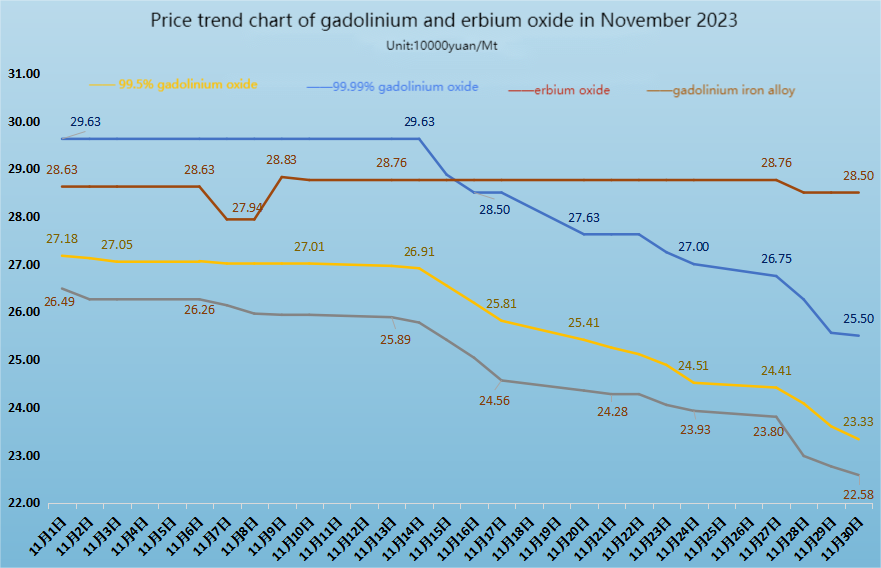

The price changes of mainstream rare earth products in November are shown in the above figure. The price of praseodymium neodymium oxide decreased from 511500 yuan/ton to 483400 yuan/ton, with a price drop of 28100 yuan/ton; The price of praseodymium neodymium metal decreased from 628300 yuan/ton to 594000 yuan/ton, with a price drop of 34300 yuan/ton; The price of dysprosium oxide increased from 2.6475 million yuan/ton to 2.68 million yuan/ton, an increase of 32500 yuan/ton; The price of dysprosium iron decreased from 2.59 million yuan/ton to 2.5763 million yuan/ton, a decrease of 13700 yuan/ton; The price of terbium oxide has dropped from 8.0688 million yuan/ton to 7.9188 million yuan/ton, a decrease of 150000 yuan/ton; The price of holmium oxide decreased from 580000 yuan/ton to 490000 yuan/ton, a decrease of 90000 yuan/ton; The price of 99.99% high-purity gadolinium oxide decreased from 296300 yuan/ton to 255000 yuan/ton, a decrease of 41300 yuan/ton; The price of 99.5% ordinary gadolinium oxide decreased from 271800 yuan/ton to 233300 yuan/ton, a decrease of 38500 yuan/ton; The price of gadolinium iron decreased from 264900 yuan/ton to 225800 yuan/ton, a decrease of 39100 yuan/ton; The price of erbium oxide has dropped from 286300 yuan/ton to 285000 yuan/ton, a decrease of 1300 yuan/ton.

Downstream industry chain development and risks

In the context of the global economy, the prosperity and decline of the rare earth industry are deeply influenced by supply chains, technological progress, and global economic growth. Nowadays, the increasingly perfect global supply chain and rapid technological progress have led to a gradual decrease in demand for rare earths. In addition, the slowdown of global economic growth and intensified trade frictions, as well as the continuous improvement of environmental and resource protection requirements, all of these factors have greatly affected the supply and demand relationship in the rare earth market, resulting in sustained price declines.

According to the information from the China Electronic Materials Industry Association, the main market share of high-purity electronic chemicals used in integrated circuits worldwide is still occupied by foreign established chemical enterprises. The import dependence of ultra pure and high-purity reagents for 8-inch and above integrated circuits and 6th generation flat panel displays in China is still high, and there is broad room for domestic substitution. Benefiting from policy driven and advancements in rare earth polishing powder technology, downstream LCD display panels and integrated circuit industries are gradually shifting to the domestic market, and the localization process is expected to accelerate.

In terms of demand, rare earth permanent magnet materials are widely used in electronic products such as LCD TVs and smartphones. With the continuous expansion of these electronic product markets, the demand for LCD display panels is also increasing, which has driven the growth of demand for rare earth permanent magnet materials. In the field of integrated circuits, rare earths are also widely used in the manufacturing process of semiconductor devices. With the development of emerging technologies such as 5G and the Internet of Things, the demand for high-performance integrated circuits is also increasing, which further drives the application of rare earths in the field of integrated circuits. The demand is rising, the business is recovering, and the pace of destocking in the rare earth industry is improving. A new cycle may begin in 2024, and the market space is expected to further open up.

In terms of supply, the supply and demand structure of rare earths is stable and tightening, and prices have upward elasticity. According to data from the Ministry of Industry and Information Technology, the total control indicators for rare earth mining and smelting in China increased by 14.29% and 13.86% respectively in 2023, a significant decrease from around 25% in 2022. There is still some support for demand for terminal trams, fans, and other equipment, and the supply and demand of praseodymium and neodymium are still in a tight balance.

Looking ahead to the future, the long-term growth trend of terminal demand for industrial robots, new energy vehicles, wind turbines, and other products remains unchanged. High performance neodymium iron boron permanent magnets are expected to continue to increase in terminal penetration rate. However, with limited supply increment, the tightening of rare earth supply and demand may drive price recovery. But the growth rate of terminal demand is lower than expected, the game between upstream and downstream is intensifying, material prices in the middle and upstream are under pressure, and the pace of supply release is significantly accelerating. In the future, with the continuous progress of technology and the development of emerging industries, the application of rare earths in these fields will continue to expand, providing broader space for the sustained development of the rare earth industry.

Post time: Dec-13-2023